Hsmb Advisory Llc Things To Know Before You Buy

Hsmb Advisory Llc Things To Know Before You Buy

Blog Article

What Does Hsmb Advisory Llc Mean?

Table of ContentsAll About Hsmb Advisory LlcThe Only Guide to Hsmb Advisory LlcHsmb Advisory Llc Things To Know Before You BuyThe 7-Second Trick For Hsmb Advisory Llc

Life insurance policy is especially vital if your family hinges on your salary. Industry specialists suggest a policy that pays out 10 times your annual income. When estimating the amount of life insurance policy you require, factor in funeral expenses. Determine your family's daily living expenses. These might consist of home loan payments, impressive fundings, bank card financial obligation, taxes, day care, and future university prices.Bureau of Labor Statistics, both partners worked and generated earnings in 48. 9% of married-couple families in 2022. This is up from 46. 8% in 2021. They would certainly be likely to experience monetary hardship as an outcome of among their breadwinner' deaths. Medical insurance can be obtained with your company, the government medical insurance industry, or exclusive insurance coverage you buy for on your own and your family by calling health and wellness insurance firms straight or experiencing a medical insurance agent.

2% of the American populace lacked insurance policy coverage in 2021, the Centers for Illness Control (CDC) reported in its National Facility for Health Statistics. Greater than 60% got their insurance coverage with a company or in the personal insurance coverage market while the rest were covered by government-subsidized programs consisting of Medicare and Medicaid, experts' benefits programs, and the government marketplace established under the Affordable Care Act.

The Greatest Guide To Hsmb Advisory Llc

If your income is reduced, you might be one of the 80 million Americans that are eligible for Medicaid.

Investopedia/ Jake Shi Long-lasting special needs insurance coverage supports those who become unable to work. According to the Social Security Administration, one in four workers getting in the workforce will certainly come to be disabled prior to they get to the age of retired life. While medical insurance pays for a hospital stay and clinical bills, you are commonly strained with all of the expenditures that your paycheck had actually covered.

This would be the very best choice for securing affordable disability coverage. If your company does not supply lasting coverage, below are some things to think about before buying insurance by yourself: A plan that assures income replacement is ideal. Many plans pay 40% to 70% of your earnings. The price of special needs insurance policy is based on several variables, including age, way of living, and wellness.

Prior to you purchase, check out the fine print. Several strategies need a three-month waiting period before the protection starts, give a maximum of three years' well worth of insurance coverage, and have considerable policy exemptions. In spite of years of renovations in automobile safety and security, an approximated 31,785 people passed away in traffic accidents on U.S.

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

Comprehensive insurance coverage covers burglary and damages to your cars and truck because of floods, hail storm, fire, criminal damage, dropping objects, and pet strikes. When you fund your auto or rent an automobile, this kind of insurance is required. Uninsured/underinsured vehicle driver (UM) coverage: If an uninsured or underinsured chauffeur strikes your lorry, this coverage pays for you and your traveler's clinical costs and may likewise represent lost earnings or make up for pain and suffering.

Employer protection is often the most effective choice, yet if that is inaccessible, obtain quotes from numerous companies as several give price cuts if you purchase even more than one type of coverage. (http://peterjackson.mee.nu/do_you_ever_have_a_dream#c1981)

Hsmb Advisory Llc - The Facts

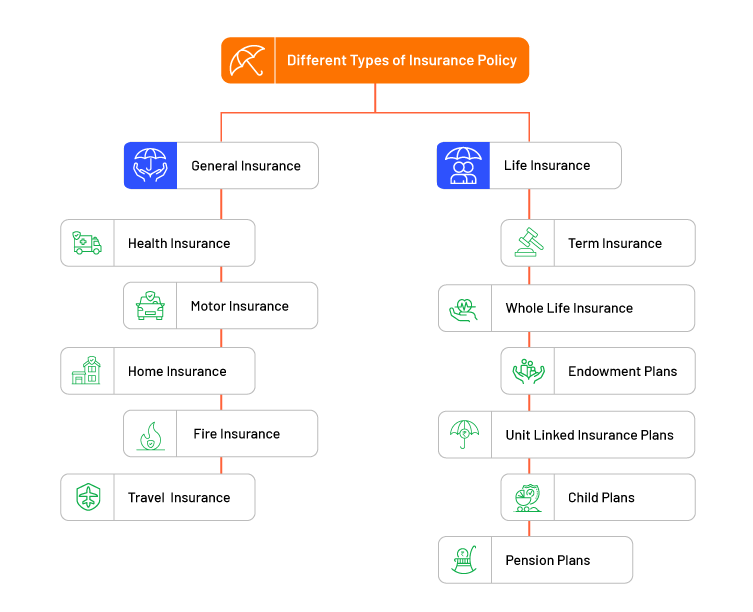

Between health and wellness insurance coverage, life insurance policy, special needs, liability, lasting, and also laptop insurance policy, the task of covering yourselfand believing concerning the limitless possibilities of what can occur in lifecan really feel frustrating. Once you recognize the principles and see to it you're sufficiently covered, insurance policy can boost monetary self-confidence and well-being. Here are one of the most vital kinds of insurance you need and what they do, plus a couple ideas to prevent overinsuring.

Different states have various policies, but you can anticipate wellness insurance policy (which many individuals make it through their employer), vehicle insurance coverage (if you possess or drive a car), and homeowners insurance (if you have property) to be on the listing (https://hsmbadvisory.edublogs.org/2024/02/26/health-insurance-st-petersburg-fl-your-guide-to-comprehensive-coverage/). Mandatory sorts of insurance policy can transform, so check out the most current legislations from time to time, specifically prior to you renew your policies

Report this page